after tax income calculator iowa

Tax March 2 2022 arnold. C2 Select Your Filing Status.

When To Choose Munis From Outside Your Home State Charles Schwab

After Tax Income Calculator Iowa.

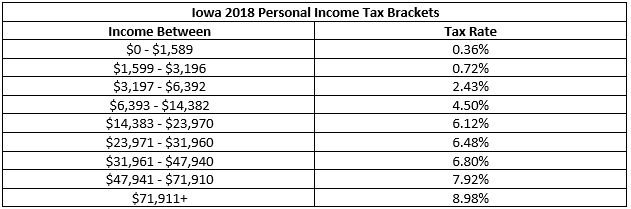

. There is also additional local income tax. That means that your net pay will be 43543 per year or 3629 per month. The state income tax rate in Iowa is progressive and ranges from 033 to 853 while federal income tax rates range from 10 to 37.

With five working days in a week this means that you are working 40 hours per week. 2023 Iowa Tax Tables with 2023 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. Using the annual income formula the calculation would be.

If you earn 60000 in a year you will take home. 60000 After Tax Explained. What is the income tax rate in Iowa.

The Iowa Income Taxes Estimator. If you make 11006320 in Iowa what will your paycheck after tax be. This is a break-down of how your after tax take-home pay is calculated on your 60000 yearly income.

Use ADPs Iowa Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Compare your take home after tax and estimate your tax. You can alter the salary example to illustrate a different filing status.

C1 Select Tax Year. Just enter the wages tax withholdings and other information required. Appanoose County has an additional 1 local income tax.

To use our Iowa Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Estimate Your Federal and Iowa Taxes. After Tax Income Calculator Iowa.

The average monthly net salary in the United States is around 2 730 USD with a minimum income of 1 120 USD per month. Many of Iowas 327 school districts levy an income surtax that is equal to a percentage of the Iowa taxes paid by residents. The state-level income tax rate ranges from 033 to 853 and residents of Appanoose county need to pay 1 local income tax.

Annual Income 15hour x 40 hoursweek. This places US on the 4th place out of 72 countries in the. The Iowa Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2023 and Iowa State Income.

Unlike the Federal Income Tax Iowas state income. If you make 55000 a year living in the region of Iowa USA you will be taxed 11457. Single Head of Household Married Filing Joint.

Your average tax rate is 1648 and your marginal tax rate is 24. This calculator computes federal income taxes state income taxes social security taxes medicare taxes self-employment tax capital gains tax and the net investment. Iowa Income Tax Calculator 2021.

If you make 119491 a year living in the region of Iowa USA you will be taxed 29697.

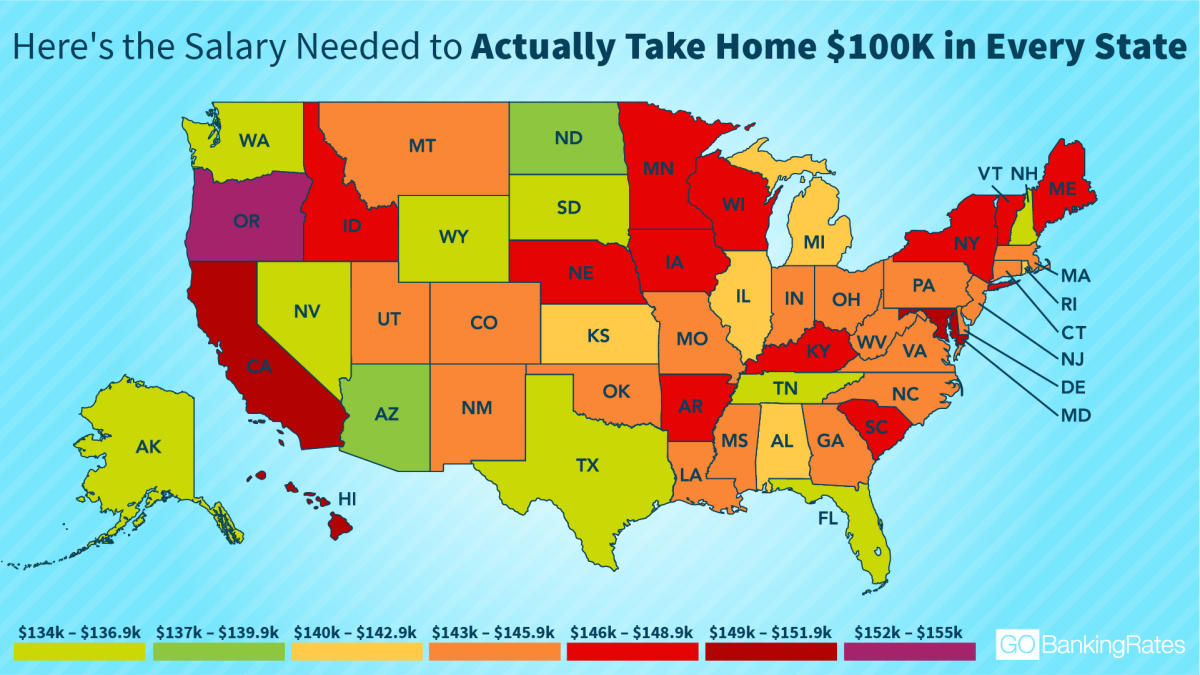

This Is The Ideal Salary You Need To Take Home 100k In Your State

How Is Tax Liability Calculated Common Tax Questions Answered

Iowa Paycheck Calculator Smartasset

Capital Gains Tax Calculator Estimate What You Ll Owe

Iowa Income Tax Calculator Smartasset

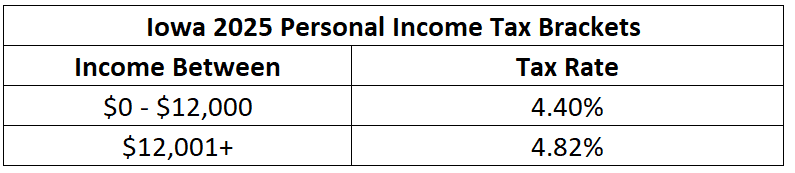

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Iowa Sales Tax Small Business Guide Truic

Monetary Eligibility Iowa Workforce Development

Tax Facts For People With Disabilities Iowa Compass

Free Paycheck Calculator Hourly Salary Take Home After Taxes

Completing The Fafsa Office Of Student Financial Aid Iowa State University

Iowa Income Tax Calculator 2022 2023

Annual Income Calculator Gross After Tax Casaplorer

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Iowa Retirement Tax Friendliness Smartasset

Iowa Income Tax Calculator 2022 2023

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax